Who Can and Cannot Seize Your Tax Refund?

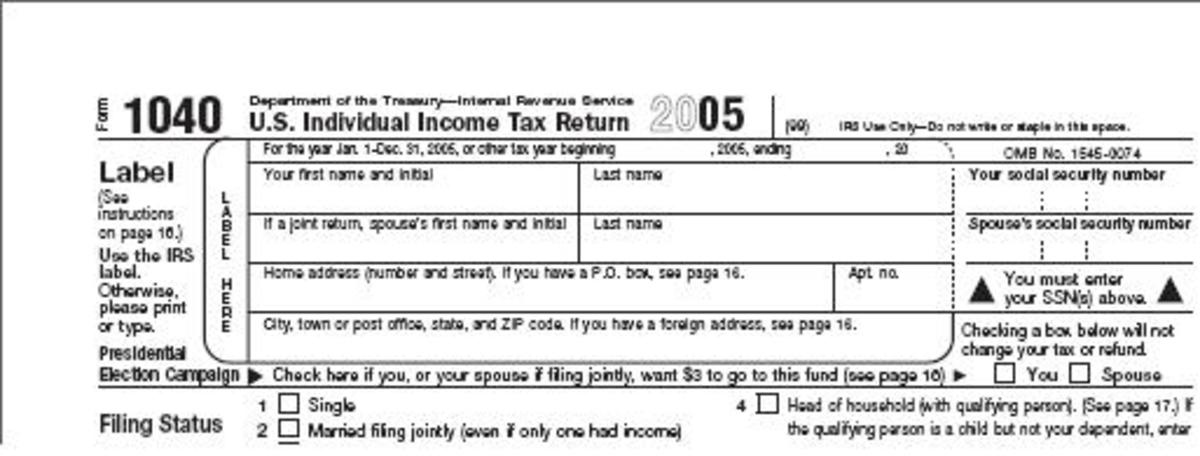

After filing your taxes, you may be eligible for a tax refund at the end of the year. Your tax refund is determined by the number of people in your household, your income and how much money you paid in federal taxes over the course of the year. In some cases, outstanding debts can cause you to lose your tax refund, but not all creditors have access to federal money.

Bankruptcy Trustees Can Seize Your Tax Refund

If you filed for Chapter 7 or Chapter 13 bankruptcy, the bankruptcy trustee in your case reserves the right to seize all or a portion of your tax refund to cover repaying your creditors. Bankruptcy doesn’t just provide you with the right to discharge your obligation to outstanding and overdue debts. You’ll be expected to contribute as much money as possible to your creditors before a the court will discharge your case.

A trustee can intercept a tax refund or require you to turn it over to the court If you fail to turn over your tax refund during the allotted time period, the court may dismiss your bankruptcy case. The amount of your tax refund the bankruptcy trustee can seize depends upon when you file, who you file with and a variety of other factors. Spending your tax refund before you file for bankruptcy protects it from seizure as long as you spend the money on household necessities rather than luxury items. Spend the money on luxury items and the court will expect you to repay your tax refund in full lest your bankruptcy case be dismissed.

The Government Can Seize Your Tax Refund

If you owe a debt to the federal government that’s in default, you’re unlikely to ever see your tax refund. This is because the federal government will intercept your refund and apply it to your outstanding debt for as long as your debt is in default. This is a common practice with student loan debts and IRS debts that go unpaid.

Not only can the government seize your tax refund, it can also withhold other forms of income that are traditionally exempt from garnishment and seizure such as Social Security benefits and retirement pensions.

A Collection Agency Cannot Seize Your Tax Refund

Collection agencies are private creditors and, as such, cannot seize or intercept tax refunds. This doesn’t stop debt collectors from threatening to do so, however.

The Fair Debt Collection Practices Act states that its illegal for a debt collector to threaten any action to which it is not legally entitled – this includes threatening to intercept or garnish your tax refund. If you can prove that a collection agency threatening to take your tax refund, you have the right to sue them.

Private Creditors Cannot Seize Your Refund

Like collection agencies, private creditors (credit card companies, hospitals, etc) are not legally permitted to garnish your tax refund. Once your tax refund hits your bank account, however, the money is fair game for a bank account levy.

Bank account levies aren’t permitted in every state, but if your state allows the practice, a private creditor can sue you, obtain a judgment against you, and use its judgment to seize your tax refund from your checking or savings account after you deposit it.