Credit Reporting Fraud by a Collection Agency

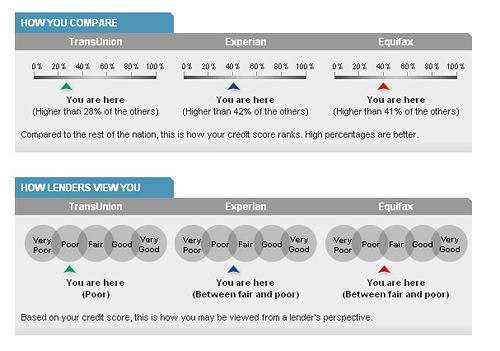

Mistakes on credit reports happen. That’s just one of the more unfortunate facts of life. If, however, you notice a debt on your credit report that seems to strangely never fall off or a debt you know for a fact you don’t owe and have already had removed from your report, you may be the victim of credit reporting fraud by a collection agency.

The difference between random errors and genuine credit reporting fraud is the fact that errors occur without malice and are unintentional. Maybe your credit card company reported your middle name wrong, or perhaps your mortgage lender butchered your address. These errors may be irritating, but they aren’t intentional and they don’t affect your credit score.

When a collection agency misreports information, however, it often does know knowing that the report is inaccurate and hoping that the consumer falls into the trap of believing that if he just pays the debt, the credit damage will go away (it won’t).

Types of Credit Reporting Fraud

There are multiple types of credit reporting fraud. Keep in mind that a collection account appearing on your credit report does not necessarily indicate credit reporting fraud, even if you have no knowledge of the debt or are certain that the debt does not belong to you. The following types of credit reporting practices, however, almost always indicate intentional fraud:

- Reaging - Every debt has a reporting perod. After the reporting period expires, the credit bureaus’ computers will remove the debt from your credit report. When a collection agency reages a consumer account, they change the original date on the account to reflect a more recent date. This can result in the collection account hanging around on a credit report for ten years or longer and is one of the most common forms of credit reporting fraud by collection agencies.

- Reporting During the Debt Validation Period - Another common form of credit reporting fraud occurs when a collection agency reports a collection account to the credit bureaus during the validation period. When you receive an initial communication from a debt collector, you have 30 days to dispute the debt in writing. During this 30 day period, the collection agency must wait to receive a dispute from you. Once the 30 day period expires, it can begin collection activity in earnest. What many consumers do not realize, however, is that they have the legal right to dispute a collection debt at any time. Once the collection agency receives the dispute, it must once again halt all collection activity until it provides the consumer with a full debt validation. Reporting during either validation period, therefore, constitutes credit reporting fraud by a collection agency.

- Reporting Debt In Contrast to an Agreement - If you paid a collection agency in exchange for a deletion of the collection account from your credit report, yet the collection agency merely updated the account as “paid”, you have been a victim of credit reporting fraud by a collection agency. If you have a written and signed agreement that demonstrates the fraud, this is an easy situation to clear up. If not, then it’s a hard way to learn the valuable lesson to get everything in writing when dealing with debt collectors.

- Reporting One Collection Account on Top of Another - If your debt stems from an old hospital bill or credit card charge-off, the original account hurts your credit score. When the debt is then sold to a collection agency and that collection agency inserts a collection account into your credit report, your credit score will drop further. Unless the collection agency opts to sue you and obtain a judgment against you, however, this should be the end of the credit damage from the original debt. Should a collector give up all hope of you ever paying the debt, it will often sell your account to another collection agency known as a “junk debt buyer”. Junk debt buyers are unscrupulous collectors who often violate collection laws. If a junk debt buyer reports another collection account on top of the previous collection account, this is credit reporting fraud.

- Reporting a Collection Account After the Reporting Period has Expired - The reporting period for most debts is seven years plus 180 days. After 180 days, most creditors will charge off an account. Any further accounts that appear on your credit report related to the original debt are also bound by the original debt’s reporting period. Once the original debt disappears from your credit report, any subsequent collection account must vanish as well (this does not apply to judgments). If a collection agency or junk debt buyer inserts a collection account onto your credit report after the reporting period has expired for the original debt, you have been a victim of credit reporting fraud by a collection agency.

Take a Collection Agency to Court for FDCPA violations.

How to Handle Credit Reporting Fraud

Notify the collection agency via mail that it has committed a violation of the Fair Debt Collection Practices Act. Demand that the collection agency immediately correct the credit reporting error lest you be forced to take legal action. Always send all letters to a collection agency via certified or registered mail and request a return receipt. Unless they have to sign for it, collection agents will conveniently not receive it.

You may also contact the credit bureaus that are currently reporting the error, Dispute the derogatory entry on your credit report and ask for an investigation. Each credit bureau then has 30 days to investigate the item and remove it from your credit record. If they fail to remove the item, this means the collection agency has verified the item’s accuracy with the credit bureaus and…wouldn’t you know it, that’s illegal if it isn’t true.

Sue the collection agency. This should be a last resort, but will be immensely satisfying if you win. More often than not, collection agencies immediately remove their entries from your credit report and decide to “play nice” once you file a lawsuit. You may then choose to drop the suit. If you go through with your lawsuit, make sure to bring documentation proving that the collection agency has, in fact, committed credit reporting fraud.

Disclaimer: I am not an attorney and this is not to be taken as legal advice. See a licensed attorney in your state for guidance specific to your situation.